Ed Yardeni: the lasting Bull Case for investing in the Stock Market

Ed Yardeni is one of the most influential voices on Wall Street. In this interview, he explains why we’re in the “Roaring '20s,” how he coined the terms Bond Vigilantes and the Fed Model, and why being a permabull has been his successful strategy for the last 45 years.

183. Ed Yardeni: the lasting Bull Case for investing in the Stock Market

Risorse

Punti Chiave

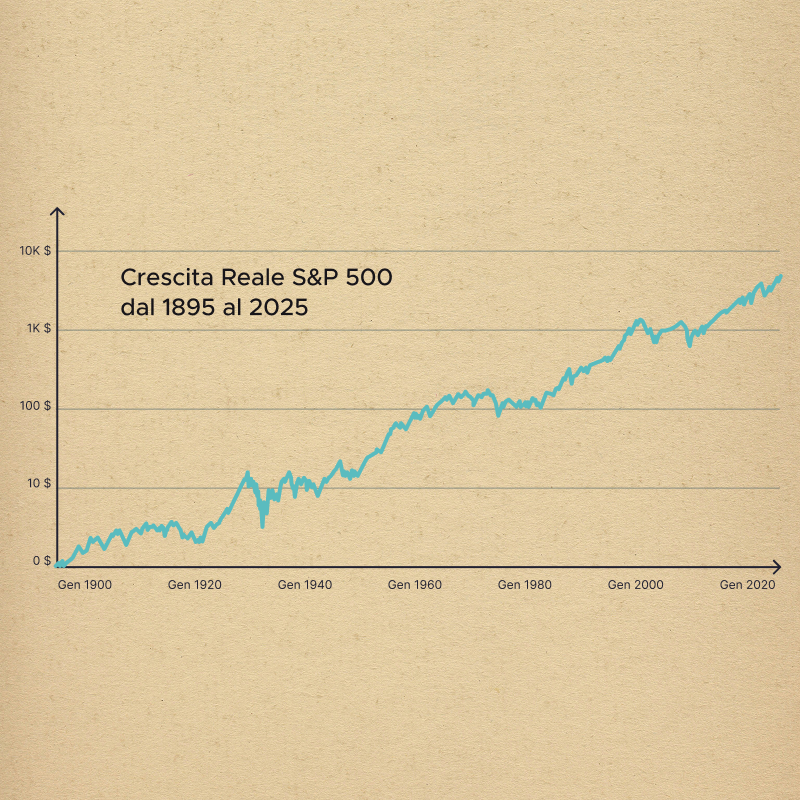

Siamo nei 'Roaring 2020s' (simili agli anni '20 del '900) grazie all'innovazione tecnologica che spinge la produttività e la crescita economica.

Il concetto di 'Bond Vigilantes' (vigilanti obbligazionari) indica che il mercato obbligazionario può imporre disciplina fiscale ai governi, facendo alzare i tassi se il debito è fuori controllo.

Le previsioni di Yardeni per l'S&P 500 sono molto ottimistiche, basate sulla resilienza dell'economia USA e il contenimento dell'inflazione.

Trascrizione Episodio

Welcome back to The Bull – your personal finance podcast. This episode couldn’t have come at a better time. Right now, the whole system seems to be starting to creak.

On Monday the 27th, we woke up to what seemed like Hurricane DeepSeek—the new Chinese artificial intelligence model that shook all the big American tech companies. They thought they were light-years ahead in this field, only to get a rude awakening.

Compared to what happened over the weekend, though, DeepSeek was just a gentle tap.

Donald J. Trump had been saying throughout his campaign that he would impose tariffs left and right, and so he did.

First victims: Canada, Mexico, and to some extent, China.

In particular, the 25% tariffs on imports from Canada and Mexico came as a shock, especially since both economies rely almost entirely on trade with the United States.

And Trump has already threatened further measures, particularly against the European Union.

The markets, as expected, didn’t exactly react with a smile. Until the last moment, they didn’t believe Trump was serious, nor that he would take such a heavy-handed approach, kicking off what could be a dangerous Trade War.

But let’s hold off on drawing quick conclusions.

The news is still too fresh, and we don’t yet have enough information to say anything truly insightful.

This, however, reminds us once again that an investor’s life is constantly accompanied by unexpected news.

There are always plenty of reasons to lose confidence in the future.

Keeping a steady hand, especially when it feels like we’re at the beginning of the end, is an entirely different challenge.

That’s why no one better than Dr. Ed Yardeni—an absolute legend in the American financial world and one of the most authoritative voices out there—can help us broaden our perspective and understand what truly matters in the long run when it comes to financial markets.

I interviewed Dr. Yardeni about ten days before this episode was released, so there will be no mention of the tariff issue.

However, we had an in-depth discussion about the financial landscape, the bond vigilantes—a concept he himself coined—the Fed model, another framework he introduced, and, more generally, the strong case for being a Permabull.

Without further ado, I leave you with my conversation with the great Dr. Ed Yardeni.

Riccardo: Dear Dr. Ed, welcome to my podcast, The Bull.

Ed Yardeni: Well, you invited me, and it sounds like you have an interesting access to a big audience that’s very interested in the stock market. I’m very interested in the stock market, so we can have a nice conversation. Right.

Riccardo: It’s great that you’re here. You’re kind of a legend on Wall Street and I’m pretty sure you will deliver great value today. I’d like to start with the current situation. Could you please explain to us why you think we are in the Roaring Twenties?

Ed Yardeni: Well, I started talking about the current decade back in 2019. It seemed to me that there’s something rhymes about the 1920s and the 2020s. And more specifically, of course, and seriously, we had a productivity boom during the 1920s. The 1920s started out very badly… So nobody was optimistic about the outlook for the 1920s back then, but it did turn out to be the roaring 1920s, with all sorts of technological innovations… And the U.S. economy boomed. As a result, we had a huge stock market rally. It ended badly, which we should discuss, of course. But this time around, we have a similar situation. We’ve got tremendous technological innovations. We’ve got a problem, which is a shortage of skilled labor. So in some ways, it’s not a forecast, it’s an extrapolation. This is where we’re likely to go. And so I think productivity growth, currently 2%, could end up the decade closer to 3% or maybe even 4%. And that would be a big booster to economic growth. It would keep inflation down. It would be a tremendous source of purchasing power. Wages would rise faster than prices, and profit margins would increase. I mean, there’s nothing bad about better-than-expected productivity. The only question is, will there be some events along the way that cause a recession, or will the roaring 2020s continue into the 2030s? I think that might be the case. I’m not saying there’ll never be a recession again, but I think recessions don’t last very long, and the outlook is really quite bright.

Riccardo: You were the one who made the closest prediction last year about the End Year target for the S&P 500. If I remember it right, you called 5,400. It was the highest record. And for this year you have forecasted 7,000.

Ed Yardeni: I called 5,400 at the beginning of last year, and we got there by the middle of it. Yeah, then I raised it again to 5,800 in the middle of the year, and we closed relatively close to that level. I also got the year before that right. I think that what differentiated our outlook, why we were more bullish than most economists and strategists, is because we did not believe that there was going to be a recession. And that was the big call, is that there would not be a recession and that inflation would moderate. And so we got those two right, which then led to a correct call on the stock market. But as they say in our business, past performance is no guarantee of future returns. But we continue to work hard to try to get the markets right. [7,000 this year, 8,000 next year, 10,000 by 2029, by the end of the roaring 2020s.]

Riccardo: Something that could cause things to fall apart may have to do with the treasury yields. You conceived the concept of bond vigilantes. Could you tell us what that means? In particular, you kept telling us since last September, when the Fed started lowering rates, that the Fed shouldn’t have cut the Fed funds rate that much.

Ed Yardeni: Well, I first talked about the bond vigilantes. I used that phrase in July of 1983. I’ve been doing this for a while… Paul Volcker came in as Fed chairman in the late 70s, raised interest rates until they broke the economy… And I argued that if the Federal Reserve and the government administration, Congress, and the president would not properly manage the economy, the bond vigilantes would step in, and they would maintain law and order in the financial markets in order to bring inflation down. And it worked, actually, in the 1980s quite well as a way to think about the markets… But the bond vigilantes are watching. And I think, like Bill Clinton, Donald Trump is probably getting the message from some of his economic advisors that with so much debt outstanding, he’s got to be very careful about maintaining some fiscal discipline, or the bond deal will go to 5%, 5.5%, 6%. And the bond deal will go to whatever level it takes to get the politicians to realize that they’ve got to get fiscal policy on a sustainable course. They’ve got to do something to keep this deficit from just exploding to infinity and beyond.

Riccardo: Are you concerned about the current huge amount of US debt and deficit and about the possibility the yields go up above 5%? The feeling is that everyone thinks that 5% is a sort of terror threshold, beyond which everything must necessarily collapse.

Ed Yardeni: The reality is, last year, the bond yield got to 5%, and there were plenty of buyers at 5%, and it didn’t kill the economy, and the stock market went on to new highs. This time around, there was a lot of talk about going back to 5% and higher, and the market got to, what, 4.75%, basically, and there were lots of buyers. Why? Because inflation news has been moderating recently… But the bond vigilantes are watching. And I think, like Bill Clinton, Donald Trump is probably getting the message from some of his economic advisors that with so much debt in circulation, he’s got to be very careful about maintaining some fiscal discipline, or the bond yield will go to 5%, 5.5%, 6%. And the bond yield will go to whatever level it takes to make the politicians realize that they’ve got to get fiscal policy on a sustainable course. They’ve got to do something to keep this deficit from just exploding to infinity and beyond.

Riccardo: Has our view become biased by the quantitative easing from 2008 to 2021? We have been close to zero interest rates for a very long time. Now we are accustomed to thinking that having a Fed funds rate above one or two percent is a problem.

Ed Yardeni: And I’ve always said that when the bond market worries about the deficit and the debt, I’ll worry about it. Because for over 40 years, there’s been alarmists, pessimists, doomsayers who’ve been predicting that the deficit and the debt would bring the economy down, and you don’t want to be in the stock market. And they’ve been wrong. So one has to be open-minded in thinking about markets and listen to the markets themselves. And if the bond market can absorb all these securities, interest rates that aren’t killing the economy, where earnings are still growing and the stock market is still going up, you have to respect that. But at the same time, there’s a legitimate concern about out-of-control fiscal policy… I think 4.5% is the right level… That’s where it was before the great financial crisis. That’s where it was before the Fed really started to intervene and manipulate the bond yield.

Riccardo: Okay.

Ed Yardeni: I think we have to take into consideration that the world has never been wealthier. There’s a tremendous amount of wealth in the global economy… [The US household sector] has a wealth of 285 dollars per share this year, 400 dollars per share by 2029. And I think profit margins are going to go up to a new record high. I mean, this is all not so much a forecast as an extrapolation of what’s actually happened… You know, we’re seeing some of the craziness that we saw in the 1920s with, you know, the excitement about cryptocurrencies. I mean, the amazing thing was Trump became a billionaire again with issuing the Trump Memcoin. You know, that’s the kind of crazy stuff that we saw back in the 1920s. But fortunately, there’s still a lot of very solid fundamentals.

Riccardo: Professor Fama, thank you so much for all the time we spent together. It was a great pleasure to have you here.

Ed Yardeni: Okay. My pleasure, actually. Thank you. Bye. Bye. Bye. Bye.

And that’s all, folks!

I hope you enjoyed this episode and that Dr. Ed has filled you with the same energy and enthusiasm he gave me while listening to him.

A big thanks once again to Ed Yardeni, and a reminder that you can follow all his market analyses on the Yardeni Research website, which you’ll find in the episode description.

As always, I invite you to hit follow and turn on notifications on Spotify, Apple Podcasts, or wherever you’re listening, and to leave a 5-star review to support us. That helps us keep producing content that explains why, in finance, if you want to sound smart, you should be a pessimist—but if you actually want to be right, you’d better always be an optimist.

That’s really all for this episode. I’ll see you next Sunday for another session together, right here, of course, on The Bull—your personal finance podcast.

Welcome back to The Bull – your personal finance podcast. This episode couldn’t have come at a better time. Right now, the whole system seems to be starting to creak.

On Monday the 27th, we woke up to what seemed like Hurricane DeepSeek—the new Chinese artificial intelligence model that shook all the big American tech companies. They thought they were light-years ahead in this field, only to get a rude awakening.

Compared to what happened over the weekend, though, DeepSeek was just a gentle tap.

Donald J. Trump had been saying throughout his campaign that he would impose tariffs left and right, and so he did.

First victims: Canada, Mexico, and to some extent, China.

In particular, the 25% tariffs on imports from Canada and Mexico came as a shock, especially since both economies rely almost entirely on trade with the United States.

And Trump has already threatened further measures, particularly against the European Union.

The markets, as expected, didn’t exactly react with a smile. Until the last moment, they didn’t believe Trump was serious, nor that he would take such a heavy-handed approach, kicking off what could be a dangerous Trade War.

But let’s hold off on drawing quick conclusions.

The news is still too fresh, and we don’t yet have enough information to say anything truly insightful.

This, however, reminds us once again that an investor’s life is constantly accompanied by unexpected news.

There are always plenty of reasons to lose confidence in the future.

Keeping a steady hand, especially when it feels like we’re at the beginning of the end, is an entirely different challenge.

That’s why no one better than Dr. Ed Yardeni—an absolute legend in the American financial world and one of the most authoritative voices out there—can help us broaden our perspective and understand what truly matters in the long run when it comes to financial markets.

I interviewed Dr. Yardeni about ten days before this episode was released, so there will be no mention of the tariff issue.

However, we had an in-depth discussion about the financial landscape, the bond vigilantes—a concept he himself coined—the Fed model, another framework he introduced, and, more generally, the strong case for being a Permabull.

Without further ado, I leave you with my conversation with the great Dr. Ed Yardeni.

Riccardo: Dear Dr. Ed, welcome to my podcast, The Bull.

Ed Yardeni: Well, you invited me, and it sounds like you have an interesting access to a big audience that’s very interested in the stock market. I’m very interested in the stock market, so we can have a nice conversation. Right.

Riccardo: It’s great that you’re here. You’re kind of a legend on Wall Street and I’m pretty sure you will deliver great value today. I’d like to start with the current situation. Could you please explain to us why you think we are in the Roaring Twenties?

Ed Yardeni: Well, I started talking about the current decade back in 2019. It seemed to me that there’s something rhymes about the 1920s and the 2020s. And more specifically, of course, and seriously, we had a productivity boom during the 1920s. The 1920s started out very badly… So nobody was optimistic about the outlook for the 1920s back then, but it did turn out to be the roaring 1920s, with all sorts of technological innovations… And the U.S. economy boomed. As a result, we had a huge stock market rally. It ended badly, which we should discuss, of course. But this time around, we have a similar situation. We’ve got tremendous technological innovations. We’ve got a problem, which is a shortage of skilled labor. So in some ways, it’s not a forecast, it’s an extrapolation. This is where we’re likely to go. And so I think productivity growth, currently 2%, could end up the decade closer to 3% or maybe even 4%. And that would be a big booster to economic growth. It would keep inflation down. It would be a tremendous source of purchasing power. Wages would rise faster than prices, and profit margins would increase. I mean, there’s nothing bad about better-than-expected productivity. The only question is, will there be some events along the way that cause a recession, or will the roaring 2020s continue into the 2030s? I think that might be the case. I’m not saying there’ll never be a recession again, but I think recessions don’t last very long, and the outlook is really quite bright.

Riccardo: You were the one who made the closest prediction last year about the End Year target for the S&P 500. If I remember it right, you called 5,400. It was the highest record. And for this year you have forecasted 7,000.

Ed Yardeni: I called 5,400 at the beginning of last year, and we got there by the middle of it. Yeah, then I raised it again to 5,800 in the middle of the year, and we closed relatively close to that level. I also got the year before that right. I think that what differentiated our outlook, why we were more bullish than most economists and strategists, is because we did not believe that there was going to be a recession. And that was the big call, is that there would not be a recession and that inflation would moderate. And so we got those two right, which then led to a correct call on the stock market. But as they say in our business, past performance is no guarantee of future returns. But we continue to work hard to try to get the markets right. [7,000 this year, 8,000 next year, 10,000 by 2029, by the end of the roaring 2020s.]

Riccardo: Something that could cause things to fall apart may have to do with the treasury yields. You conceived the concept of bond vigilantes. Could you tell us what that means? In particular, you kept telling us since last September, when the Fed started lowering rates, that the Fed shouldn’t have cut the Fed funds rate that much.

Ed Yardeni: Well, I first talked about the bond vigilantes. I used that phrase in July of 1983. I’ve been doing this for a while… Paul Volcker came in as Fed chairman in the late 70s, raised interest rates until they broke the economy… And I argued that if the Federal Reserve and the government administration, Congress, and the president would not properly manage the economy, the bond vigilantes would step in, and they would maintain law and order in the financial markets in order to bring inflation down. And it worked, actually, in the 1980s quite well as a way to think about the markets… But the bond vigilantes are watching. And I think, like Bill Clinton, Donald Trump is probably getting the message from some of his economic advisors that with so much debt outstanding, he’s got to be very careful about maintaining some fiscal discipline, or the bond deal will go to 5%, 5.5%, 6%. And the bond deal will go to whatever level it takes to get the politicians to realize that they’ve got to get fiscal policy on a sustainable course. They’ve got to do something to keep this deficit from just exploding to infinity and beyond.

Riccardo: Are you concerned about the current huge amount of US debt and deficit and about the possibility the yields go up above 5%? The feeling is that everyone thinks that 5% is a sort of terror threshold, beyond which everything must necessarily collapse.

Ed Yardeni: The reality is, last year, the bond yield got to 5%, and there were plenty of buyers at 5%, and it didn’t kill the economy, and the stock market went on to new highs. This time around, there was a lot of talk about going back to 5% and higher, and the market got to, what, 4.75%, basically, and there were lots of buyers. Why? Because inflation news has been moderating recently… But the bond vigilantes are watching. And I think, like Bill Clinton, Donald Trump is probably getting the message from some of his economic advisors that with so much debt in circulation, he’s got to be very careful about maintaining some fiscal discipline, or the bond yield will go to 5%, 5.5%, 6%. And the bond yield will go to whatever level it takes to make the politicians realize that they’ve got to get fiscal policy on a sustainable course. They’ve got to do something to keep this deficit from just exploding to infinity and beyond.

Riccardo: Has our view become biased by the quantitative easing from 2008 to 2021? We have been close to zero interest rates for a very long time. Now we are accustomed to thinking that having a Fed funds rate above one or two percent is a problem.

Ed Yardeni: And I’ve always said that when the bond market worries about the deficit and the debt, I’ll worry about it. Because for over 40 years, there’s been alarmists, pessimists, doomsayers who’ve been predicting that the deficit and the debt would bring the economy down, and you don’t want to be in the stock market. And they’ve been wrong. So one has to be open-minded in thinking about markets and listen to the markets themselves. And if the bond market can absorb all these securities, interest rates that aren’t killing the economy, where earnings are still growing and the stock market is still going up, you have to respect that. But at the same time, there’s a legitimate concern about out-of-control fiscal policy… I think 4.5% is the right level… That’s where it was before the great financial crisis. That’s where it was before the Fed really started to intervene and manipulate the bond yield.

Riccardo: Okay.

Ed Yardeni: I think we have to take into consideration that the world has never been wealthier. There’s a tremendous amount of wealth in the global economy… [The US household sector] has a wealth of 285 dollars per share this year, 400 dollars per share by 2029. And I think profit margins are going to go up to a new record high. I mean, this is all not so much a forecast as an extrapolation of what’s actually happened… You know, we’re seeing some of the craziness that we saw in the 1920s with, you know, the excitement about cryptocurrencies. I mean, the amazing thing was Trump became a billionaire again with issuing the Trump Memcoin. You know, that’s the kind of crazy stuff that we saw back in the 1920s. But fortunately, there’s still a lot of very solid fundamentals.

Riccardo: Professor Fama, thank you so much for all the time we spent together. It was a great pleasure to have you here.

Ed Yardeni: Okay. My pleasure, actually. Thank you. Bye. Bye. Bye. Bye.

And that’s all, folks!

I hope you enjoyed this episode and that Dr. Ed has filled you with the same energy and enthusiasm he gave me while listening to him.

A big thanks once again to Ed Yardeni, and a reminder that you can follow all his market analyses on the Yardeni Research website, which you’ll find in the episode description.

As always, I invite you to hit follow and turn on notifications on Spotify, Apple Podcasts, or wherever you’re listening, and to leave a 5-star review to support us. That helps us keep producing content that explains why, in finance, if you want to sound smart, you should be a pessimist—but if you actually want to be right, you’d better always be an optimist.

That’s really all for this episode. I’ll see you next Sunday for another session together, right here, of course, on The Bull—your personal finance podcast.

Recensioni

Quando capisci come funziona la finanza… ti viene voglia di raccontarla!

La mia ignoranza in materia mi ha sempre creato dei dubbi, ma grazie a un amico ho iniziato ad ascoltare il podcast. Per fortuna che ho 24 anni e un po' di tempo e soldi da dedicarmi a imparare le varie nozioni per me stesso. Grazie mille!

Luca G. 10 Ott 2025Non sono solito a mettere recensioni e specialmente non ascolto podcast, ma da quando ho iniziato questo, faccio fatica a staccarmi, e quasi non posso più fare a meno di ascoltare e arricchirmi culturalmente.

Andrea V., 22 Set 2025Veramente veramente raccomandato! la finanza personale riassunta alla perfezione! e spiegata partendo dall'ABC! Ottimo anche da ascoltare a velocita 1,5x!

Giorgia R., 23 Gen 2025Podcast che dà sempre spunti interessanti che personalmente mi ha fatto appassionare alla finanza personale spingendomi ad approfondire in prima persona.

Lorenzo, 13 Mar 2025Podcast piacevole, scorre veloce ma in modo estremamente chiaro, spiega i concetti chiave per gestire le proprie finanze, fornendo la classica cassetta degli attrezzi. Complimenti, davvero ben fatto!

Massimiliano, 29 Mag 2024Ho acquistato e letto il suo libro e l' ho trovato. Esprime i concetti economici in modo semplice e chiaro. Sentirlo parlare conferma che è un professionista del settore.

Giulia N., 11 Ago 2025Ho seguito tutte le puntate! Grazie veramente

Amalia A., 17 Set 2025Dovrebbero ascoltarlo buona parte degli italiani e io avrei dovuto scoprirlo con qualche anno in anticipo ma meglio tardi che mai

Matteo C., 3 Set 2025Da quando l'ho scoperto in 15 gg mi sono ascoltato 150 puntate senza fermarmi, ho annullato gli altri podcast per portarmi alla pari ed ascoltare tutte le precedenti puntate, ben fatto, esattamente il livello di informazione che mi serviva

Gianluca G., 11 Set 2025